The past four years have been a whirlwind for the Australian construction industry. What started with a blip of uncertainty during the initial stages of the COVID-19 pandemic quickly morphed into a sustained surge in construction costs. From aspiring homeowners to seasoned developers, everyone involved in building projects has felt the pinch. This blog post delves deeper into the specifics of this phenomenon, analyzing the contributing factors, exploring regional variations, and offering tips for navigating the current landscape.

The Australian Construction Industry: A Snapshot

The construction industry is Australia’s major economic driver, representing approximately 8 to 9% of the national GDP as well as employing over 1.35 million people across various construction sectors. This significant employment translates into household income and consumer spending, contributing to overall economic activity.

From roads and bridges to public transportation networks and utilities, the construction industry is responsible for creating and maintaining Australia’s essential infrastructure. This infrastructure is crucial for connecting communities, facilitating trade, and supporting a high quality of life.

The industry plays a central role in meeting Australia’s housing needs and constructing new homes, apartments, and other residential structures. Furthermore, it supports commercial development, building office spaces, retail centers, and industrial facilities.

The Australian construction industry is increasingly incorporating sustainable practices. This includes utilizing eco-friendly materials, implementing energy-efficient designs, and minimizing waste during construction processes. As environmental concerns rise, the industry is adapting to create a more sustainable built environment.

The Australian construction industry is a complex and dynamic sector that plays a critical role in the nation’s economy. While facing challenges, it also presents exciting opportunities for innovation and sustainable development.

Construction Cost Baseline in Australia: Pre-COVID (2019-Early 2020)

Before the onset of the COVID-19 pandemic, the Australian construction industry was experiencing steady growth. The sector contributed significantly to the national economy, with construction activities accounting for around 7-8% of the GDP. The industry was characterized by robust residential and non-residential construction activities, as well as substantial infrastructure projects.

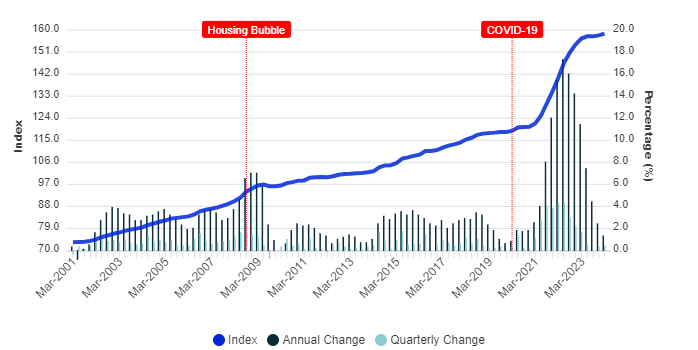

The CoreLogic Cordell Construction Cost Index (CCCI) reported a national annual increase of around 4.0% for residential building construction in the years leading up to the pandemic. This translates to a more stable and predictable cost environment compared to the significant increases witnessed in recent years. The Australian Bureau of Statistics (ABS) data on Producer Price Indexes (PPIs) for the construction industry also reflects a more moderate pre-pandemic cost environment. For example, input prices for house construction hovered around a 2-3% annual growth rate in the period leading up to 2020. Pre-COVID construction costs also exhibited some regional variations:

- Major Cities: Capital cities like Sydney and Melbourne experienced slightly higher construction costs compared to regional areas. This can be attributed to factors like higher land prices, demand for skilled labor, and complex building regulations in major urban centers.

- Regional Areas: Regional areas generally saw lower construction costs due to readily available land, lower labor rates, and less stringent regulations in some instances. However, this varied depending on the specific location and project type.

A Rollercoaster Ride: Construction Costs Since 2020

The Australian construction industry has experienced a period of dramatic price swings since the beginning of 2020. What started as a temporary blip due to the initial stages of the COVID-19 pandemic quickly morphed into a sustained period of significant cost increases.

As the pandemic unfolded in 2020, there was a temporary dip in construction activity due to initial uncertainties. This led to a slight decrease in construction costs in some areas, albeit short-lived.

- Supply Chain Disruptions: The global pandemic significantly impacted global supply chains. Shortages of essential building materials like timber, steel, and concrete became commonplace, leading to price hikes and project delays. Imagine trying to build a house without the necessary bricks!

- Skilled Labor Shortages: Australia, like many developed nations, faces a shortage of skilled tradespeople in various construction fields. This lack of qualified labor, from carpenters to electricians, drove up wages for construction workers, translating into higher project costs for builders and developers.

- Increased Demand: Despite initial hesitation, Australia’s housing market has witnessed a boom in recent years. This surge in demand, coupled with limited supply due to construction delays, further inflated costs.

- Rising Material Costs: Beyond supply chain disruptions, the general cost of raw materials has also increased. Factors like global energy price fluctuations, inflation, and environmental regulations all contributed to this phenomenon. Steel, timber, and concrete prices all saw a significant rise.

The combined effect of these factors led to a dramatic increase in construction costs. Reports suggest a peak of around 11.9% annual growth by December 2022. Building that dream home or renovating your kitchen suddenly became a much more expensive proposition.

Regional Variations: A Patchwork of Price Increases

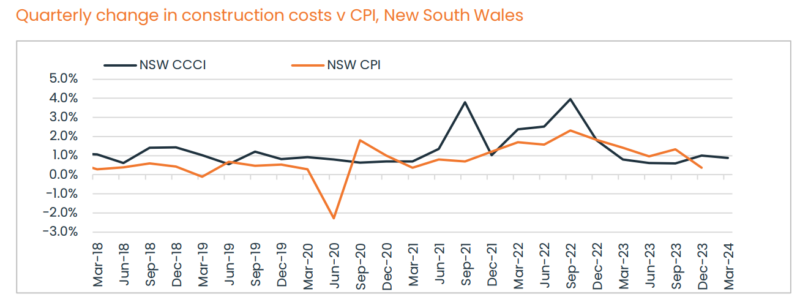

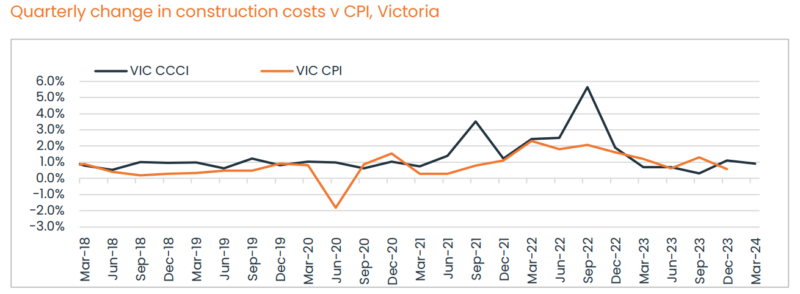

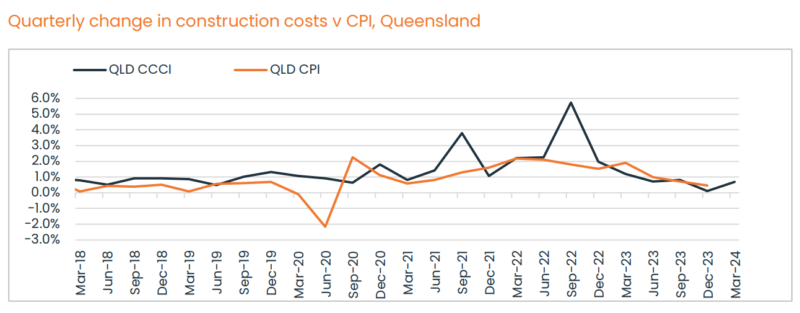

Despite the initial pandemic-related hesitation, Australia’s housing market has experienced a boom in recent years. This surge in demand, coupled with limited supply due to construction delays, has further inflated costs. This phenomenon is particularly evident in major cities like Sydney and Melbourne. For instance, price increases varied across states, with rapid growth recorded in NSW, Victoria, and WA. In contrast, SA and Queensland experienced a decline in quarterly CCCI growth.

New South Wales (NSW): The country’s most populous state has seen costs increase significantly, especially in Sydney and surrounding areas. CoreLogic figures show Sydney home values rose 0.9 percent in the three months to March, while regional NSW home values rose 1.1 percent in the quarter. However, some rural areas in NSW have slightly lower cost increases than bustling urban areas.

Victoria (VIC): Melbourne, the capital of Victoria, has also seen a significant increase in construction costs. Despite a slight decline in the quarter, CCCI Victoria’s annual growth was still up 3.1% in the year to March 2024, up from 2.9% in the year to December. This reflects high costs regarding materials, labor, and in-state compliance fees.

Queensland (QLD): Compared to NSW and VIC, Queensland had slightly more moderate construction cost increases. Queensland recorded a 0.7% increase in construction costs in the third quarter after the previous quarter saw only minimal growth (0.1%). However, some coastal areas in QLD saw costs increase. Fees are higher due to factors such as limited land funds and high demand.

Conclusion

The Australian construction industry has faced unprecedented challenges and cost pressures since 2020. Overall construction costs have risen by 20 – 30% since 2020, with variations across different sectors and regions.

The impact of the COVID-19 pandemic, coupled with global supply chain disruptions, labor shortages, and inflationary pressures, has led to significant increases in construction costs across all sectors. To navigate this challenging environment, Australian construction industry stakeholders must adopt innovative cost management strategies, embrace new technologies and construction methods, and focus on sustainable, long-term value creation.

As the industry continues to evolve, those who can adapt to these new realities and implement effective cost-management strategies will be best positioned to thrive in the changing landscape of Australian construction.

Leave a Reply