We have been told that the best time to buy is NOW. This advice can be right most of the time when considering a long-term view. However, every ten years, we have a cycle, and it’s crucial to understand this cycle to pick the right time to buy the house you will commit to for the next decades.

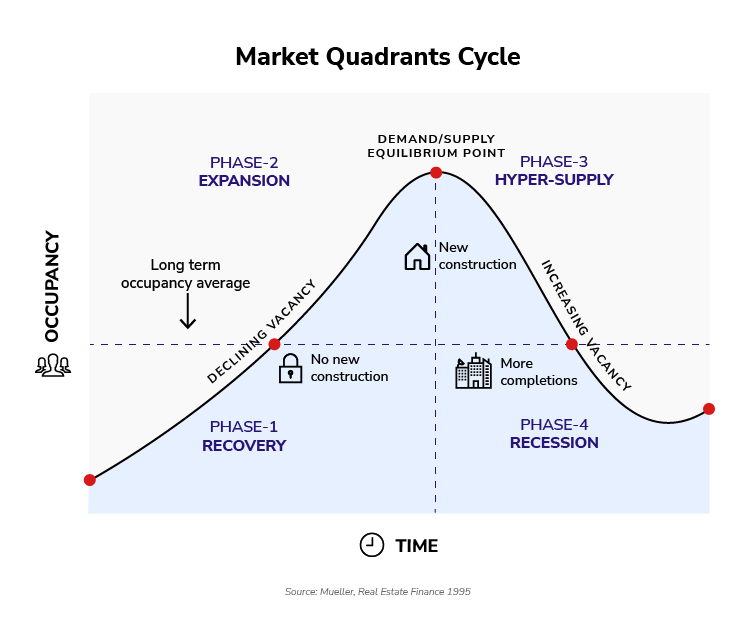

First of all, let’s understand the property cycle. Let’s look at it from different angles, starting with occupancy.

If you have been following the news, especially in major cities like Melbourne and Sydney, over the last couple of years, you would have seen reports of people lining up for house inspections, 50 renters competing for one property, and rent increasing by 10-15% over the last year, with no end in sight. As seen in the graph below, we are currently in 2020 – 2024, transitioning through Phase-1 Recovery (after COVID and a sustained period of stabilization in rent) and Phase-2 Expansion (following COVID, with a massive intake of migrants after the long halt due to the pandemic). What is next? We are definitely heading to a Demand/Supply Equilibrium point. However, this is not really an equilibrium point since we are experiencing an extreme shortage of supply. Demand remains consistent with previous years. Don’t trust the news that we are at high demand; it’s just that everyone is panicking and buying out of fear of missing out.

Another point is that the government is pushing to build $1.2M new houses over the next five years, though many sources say we will not be able to achieve that. However, it still represents a massive supply. Over the next quarter, we will be at the beginning of Phase-3 – Hyper Supply, which means more properties to choose from, better prices, and less competition. Demand will decrease as many previously potential buyers move to other cities. Rent will stabilize or even decline when investors start to find it hard to lease out properties. Demand will definitely stabilize or even reduce, with news about capping the number of students, who make up a big part of the rental market. So things are likely to get better from here.

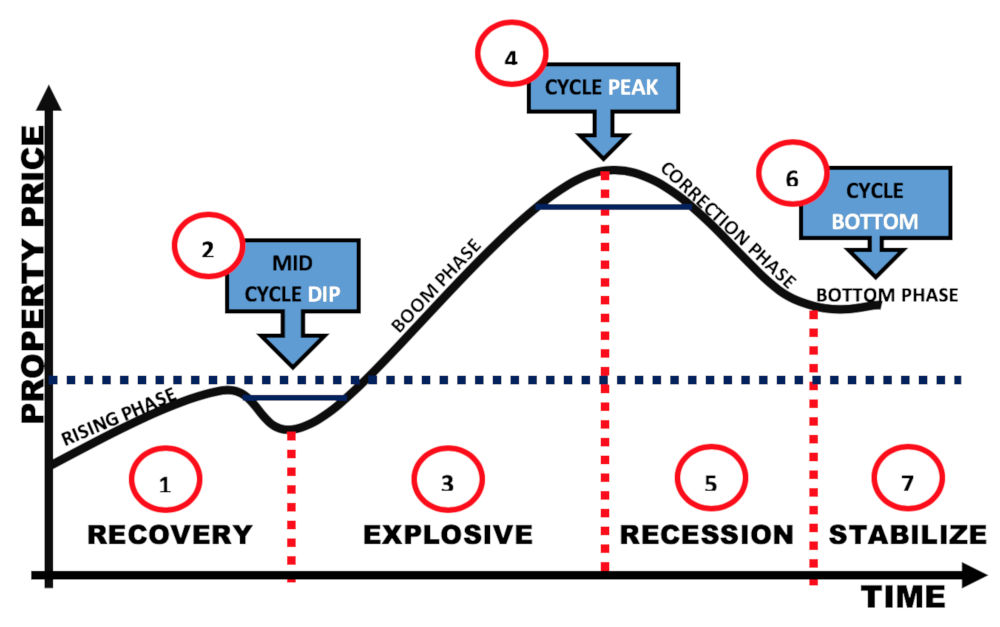

Now, let’s look at the property cycle from a price point of view. Similar to the above, we might have moved from panicking about rising property prices to being too tired of hearing this news repeatedly about how much house prices have increased over the last 3-4 years. Yes, you are right; looking at the chart below, we are at the end point of the Boom/Explosive phase, which means the correction phase is coming. Everyone wants to know when it has peaked. The reason why we are at the peak now is because, as explained above, a lot more new houses are committed to being built, and the government will fast-track these builds since everyone knows we need more houses badly. How often do you see the news that the government is even fixing old houses (a method to supply “new” houses even faster)? The correction phase is starting with the capping of demand, as explained above, due to the capping of international student intake.

Looking at the chart above, it is easy to understand why the rule of thumb about buying property is to buy NOW since even in the correction and stabilization phase, we are still in an increasing trend (broad view). However, by looking at a shorter span of time, we can pick the right time to buy. Even though we know that property prices will go up over the next 20 years, the last thing we want is to buy a not-so-desirable property when the price is at its peak. Over the next 5-7 years, we will likely not see our property value increase due to correction, and it will be hard to lease it out. Buying at the peak just because of the fear of missing out is unwise. It is hard to follow this advice from Buffet, but definitely hold tight for a better time to come: Be Fearful When Others Are Greedy. Do not follow the general market.

Leave a Reply